Primera entrada conmemorativa del año 2021

Venimos de aquí: https://moneditis.com/2025/06/07/10-anos-2020-4/

https://moneditis.com/2025/05/03/10-anos-2020-3/

https://moneditis.com/2025/04/12/10-anos-2020-2/

https://moneditis.com/2025/03/21/10-anos-2020-1/

https://moneditis.com/2025/02/21/10-anos-2019-4/

https://moneditis.com/2025/01/25/10-anos-2019-3/

https://moneditis.com/2024/12/05/10-anos-2019-2/

https://moneditis.com/2024/11/09/10-anos-2019-1/

https://moneditis.com/2024/10/19/10-anos-2018-5/

https://moneditis.com/2024/09/20/10-anos-2018-4/

https://moneditis.com/2024/08/06/10-anos-2018-3/

https://moneditis.com/2024/08/06/10-anos-2018-2/

https://moneditis.com/2024/07/12/10-anos-2018-1/

https://moneditis.com/2024/06/23/10-anos-2017-5/

https://moneditis.com/2024/06/01/10-anos-2017-4/

https://moneditis.com/2024/05/25/10-anos-2017-3/

https://moneditis.com/2024/04/27/10-anos-2017-2/

https://moneditis.com/2024/04/11/10-anos-2017-1/

https://moneditis.com/2024/03/22/10-anos-2016-4/

https://moneditis.com/2024/01/25/10-anos-2016-3/

https://moneditis.com/2024/01/25/10-anos-2016-2/

https://moneditis.com/2024/01/25/10-anos-2016-1/

https://moneditis.com/2023/12/16/10-anos-2015-5/

https://moneditis.com/2023/12/08/10-anos-2015-4/

https://moneditis.com/2023/11/25/10-anos-2015-3/

https://moneditis.com/2023/11/18/10-anos-2015-2/

https://moneditis.com/2023/11/04/10-anos-2015-1/

https://moneditis.com/2023/10/28/10-anos-2014-4/

https://moneditis.com/2023/10/14/10-anos-2014-3/

https://moneditis.com/2023/09/30/10-anos-2014-2/

https://moneditis.com/2023/09/16/10-anos-2014-1/

https://moneditis.com/2023/08/30/10-anos-2013/

Vamos a por la trigésima tercera (33) entrada conmemorativa; el enlace inferior conecta con la parte del blog tratada, a partir de enero de 2021

https://moneditis.com/page/23/

Comienza este 2021 con subasta de Goldberg en Nueva York con algún efimok, rublos… + PSII con falsificación de papel moneda y Красцветмет Metales Preciosos Reciclados , empresa rusa que absorbe el 75 % del oro, el 50 % de la plata y el 95 % de Pt, Rh, Ru, Pd, Ir y Os (PGM) del reciclado «metalero» ruso.

«Después de la limpieza química, al oro se le da la forma deseada: gránulos o lingotes. Para obtenerlos, el metal se calienta al menos a 1070 ° C. Al mismo tiempo, los moldes (moldes) se calientan en un horno, luego se retiran, se rocía grafito sobre ellos y se calienta con gas. Esto ayuda a que el oro se enfríe de manera uniforme y evita la formación de una cavidad de contracción . Derramar oro es generalmente un trabajo manual. Las fundiciones con trajes refractarios pueden determinar a simple vista cuánto oro verter en un molde para obtener un lingote del peso deseado y luego llevarlo caliente a un pequeño baño de agua fría: el 75% de todo el oro ruso lo atraviesa anualmente. Al final, los lingotes se toman para su procesamiento con el fin de moler y eliminar todo el exceso.»

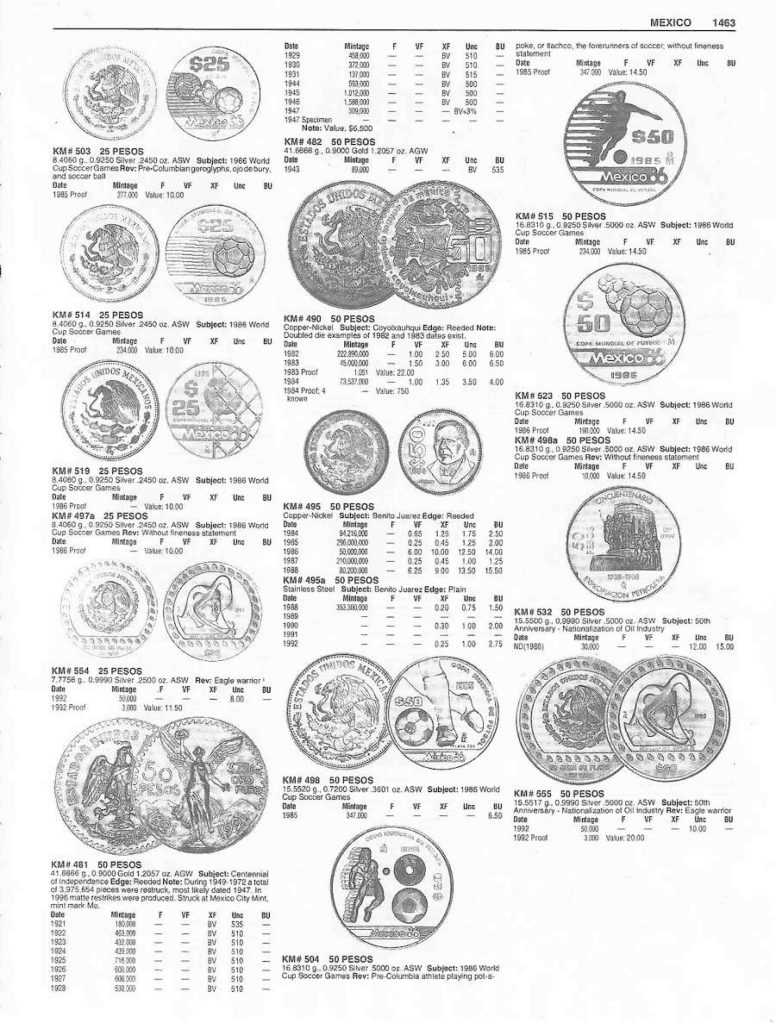

A continuación Monedas del Mundo Fascículos donde muestro y comparo enciclopedias por fascículos sobre monedas y billetes , SLV reddit wallstreetbets TheHappyHawaiian silver futures comentando el short squeeze de la plata del momento y Publicaciones sobre Moneda Falsa y Barrera Coronado , este último libro desactualizado pero curioso

Lotes de 8 reales de Carlos IV, Rublo 1726 II / Рубль 1726 II con PS soberanos falsos,

y 8 reales macuquina ¿falsa? subasta 77 Tauler&Fau

Interesante enlace https://moneditis.com/2021/03/05/8-reales-columnario-1729/ prueba de la Casa de la Moneda de Madrid

Para 1729 ya se había tomado la decisión de que la Casa de Moneda de México sería mecanizada, por lo que las nuevas monedas que se hicieran ahora allí, llevarían un nuevo diseño, hoy conocido como el diseño columnario o de dos mundos. Aunque no se conoce cómo fue seleccionado este diseño, sí se sabe que para el 8 de septiembre de 1728 ya se había escogido, citándose en un decreto fechado ese día, sen el cual se describe que la moneda que se había mandado labrar en las Indias se haría: «con el cuño de las Reales Armas de Castilla , i Leones , i en medio el escudo pequeño de las Flores de Lis , i una Granada al pie con la inscripción Philippus V. D. G. Hispan. & Indiar. Rex , i por el reverso las dos columnas coronadas con el Plus ultra, bañándolas unas ondas del mar , i entre ellas dos Mundos unidos con una Corona , que los ciñe, i por inscripción Utraque unum…» (sic).(2)

8 reales Lima 1795 Carlos IV dudosos ¿falsa? Subasta Silicua

2 euros € España 2021 conmemorativos Toledo , 2021 Dinero , «Repatinando»…que es gerundio I, primera de varias entradas sobre la técnica del repatinado y Squeeze reddit Silver Bugs WallStreet , complementando la entrada anterior de HappyHawaiian y última entrada de abril de 2021, con bucle posterior a todo esto en una mirada atrás

La próxima entrada conmemorativa, segunda del año 2021, empezará con más pátinas artificiales: técnicas y detección

Lo dejamos aquí https://moneditis.com/page/22/

Thanks…

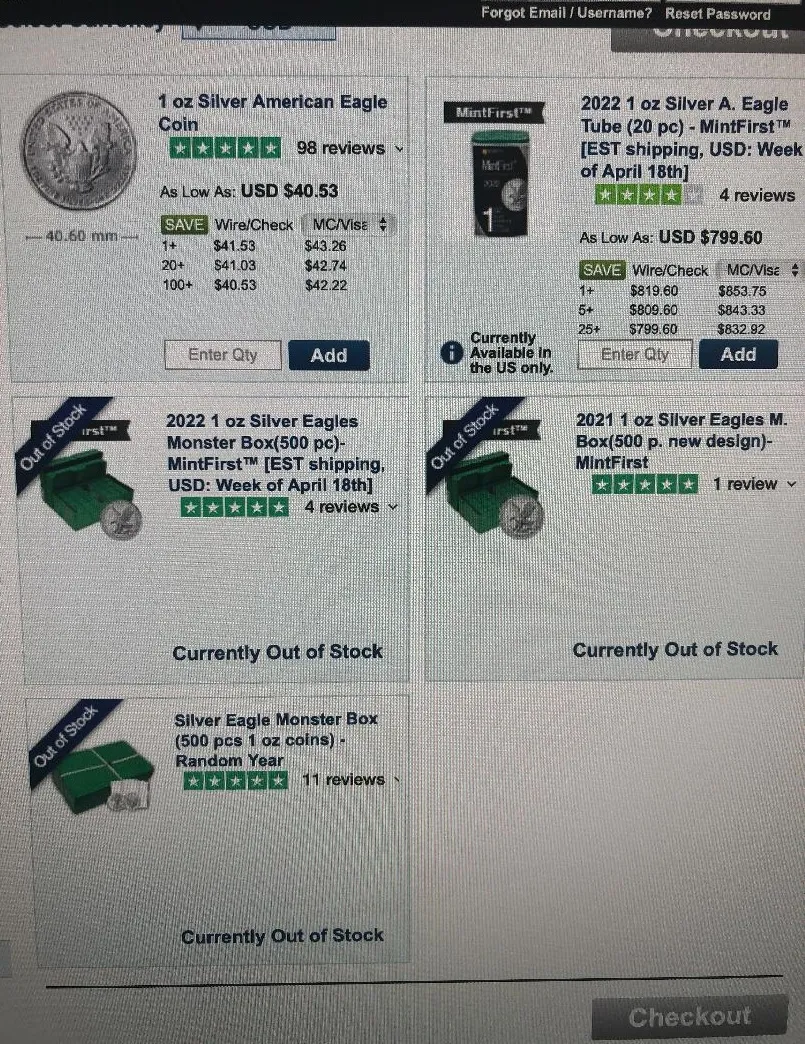

I did speak to the rep about 100oz bars, which make sense, if redeeming them in smaller quantities is something one decides to do in the future. The price of rounds, either Maple leaf or Eagles is obnoxious…I won’t buy based on principle and principal. I didn’t go any further asking about monster boxes, just because the price point was not reasonable.

100oz bars are more to my liking, although moving a lot of them isn’t.

Are you a buyer in this market? Or do we still have some blood letting to go in the overall markets?

Notice how the high prices relative to spot discourage you from getting long… Always a buyer, for the right price….

I am going long on Silver, just not in the retail packaged rounds, which command the higher premium. If those who know something big is coming around the corner in the silver market, not premium is going to deter them from buying. How many times in the past have we heard «this time is different?» Too many…and every time its the same regurgitated crap, year in year out.

I find it interesting how much time has passed between the first article you wrote on Silver, to this last one. Question is…how many more years are we going to wait until the charade in the PM markets is dismantled? The curtains have been pulled back exposing the shenanigans, yet nothing has changed. What ever happened to the Basel III implementation? Wasn’t it supposed to due away with the unallocated position limits which were used to suppress the prices of gold and silver?

This time is no different…at least, not from my perspective. The fact 1000oz bars are still available in volume, tells me the big players aren’t buying. If they were, the supply would be swallowed up by those who are already cornering the market. I can only imagine what 800,000,000 oz of Silver looks like.