Enlace a mi tienda en ebid. Iré subiendo más moneditas de mi colección

https://stores.ebid.net/moneditis

—————————————————————————————————————————————

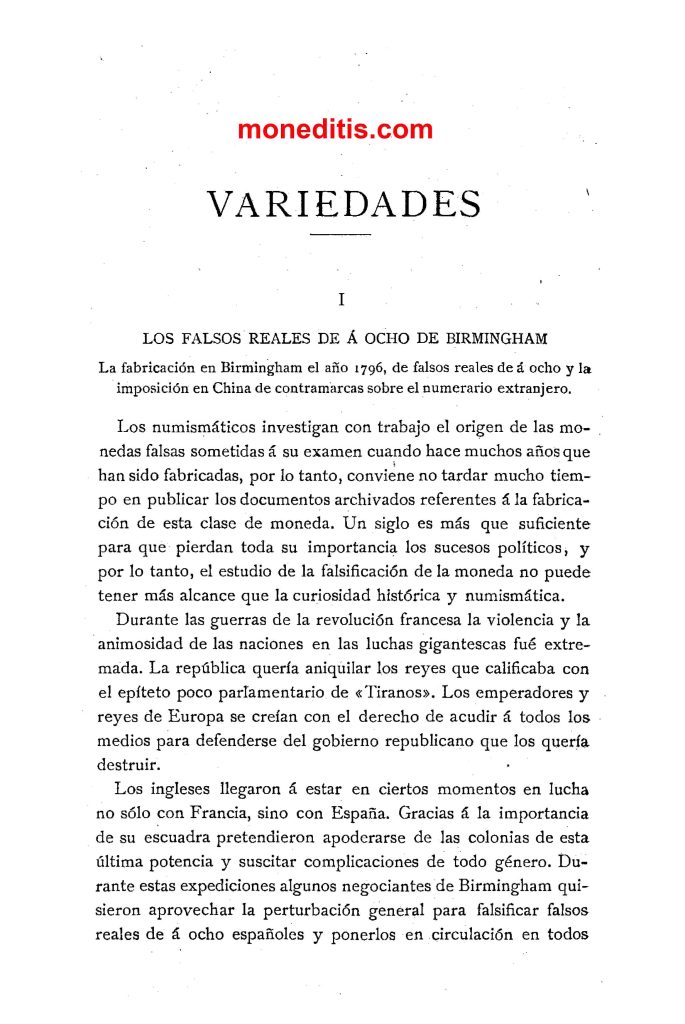

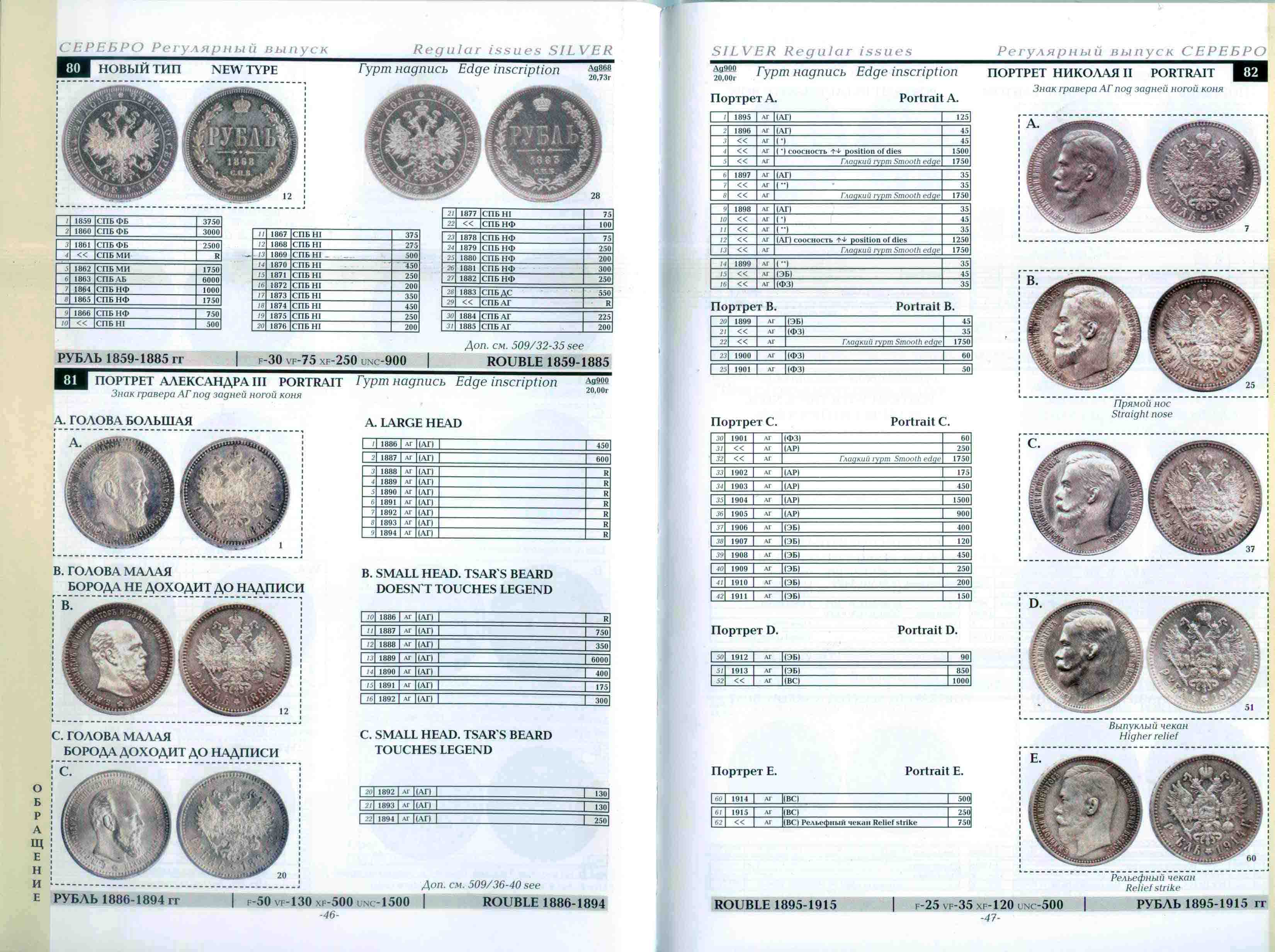

Los reales de a ocho falsos acuñados en Birmingham por los ingleses es un tema tratado ya en este blog; en esta entrada os dejo el documento original donde en 1796 Carlos de Gimbernat informa a « M. De Las Casas, embajador de España en Londres, sobre la fabricación de falsos reales de á ocho en Birmingham, por un físico español comisionado con este objeto (2)» y posterior documento de M. Théremin.

Parece que alguno de estos 8 reales fueron contramarcados en origen, habiendo varios tipos, léase forrados, prensados y reacuñados, faltos de ley, Sn…) Me centro en los tipos 1 y 3, de acuerdo con el documento.

Existiendo aún hoy cierta confusión en cuanto al tiempo durante el que estas falsificaciones fueron fabricadas, parece que se extendió durante varias décadas

Leídos diversos enfoques a lo largo y ancho de internet y que os voy a ahorrar…lo único relativamente concluyente es que no quedan muchos de aquellos reales de a ocho ingleses en la actualidad…aunque no sé yo si la multitud de duros de Carlos III y IV disponibles hoy (quizá más que en su época 😉 ) quizá provengan de China, falsos también, devolviéndonos la pelota (comercio plata ss. XVI – XVIII)

Aquí os dejo el documento completo en pdf

En este enlace tenéis la página del Barrera Coronado donde se explica todo esto https://moneditis.com/2021/02/05/publicaciones-sobre-moneda-falsa-barrera-coronado/ y os dejo a continuación un par de páginas más con ejemplos

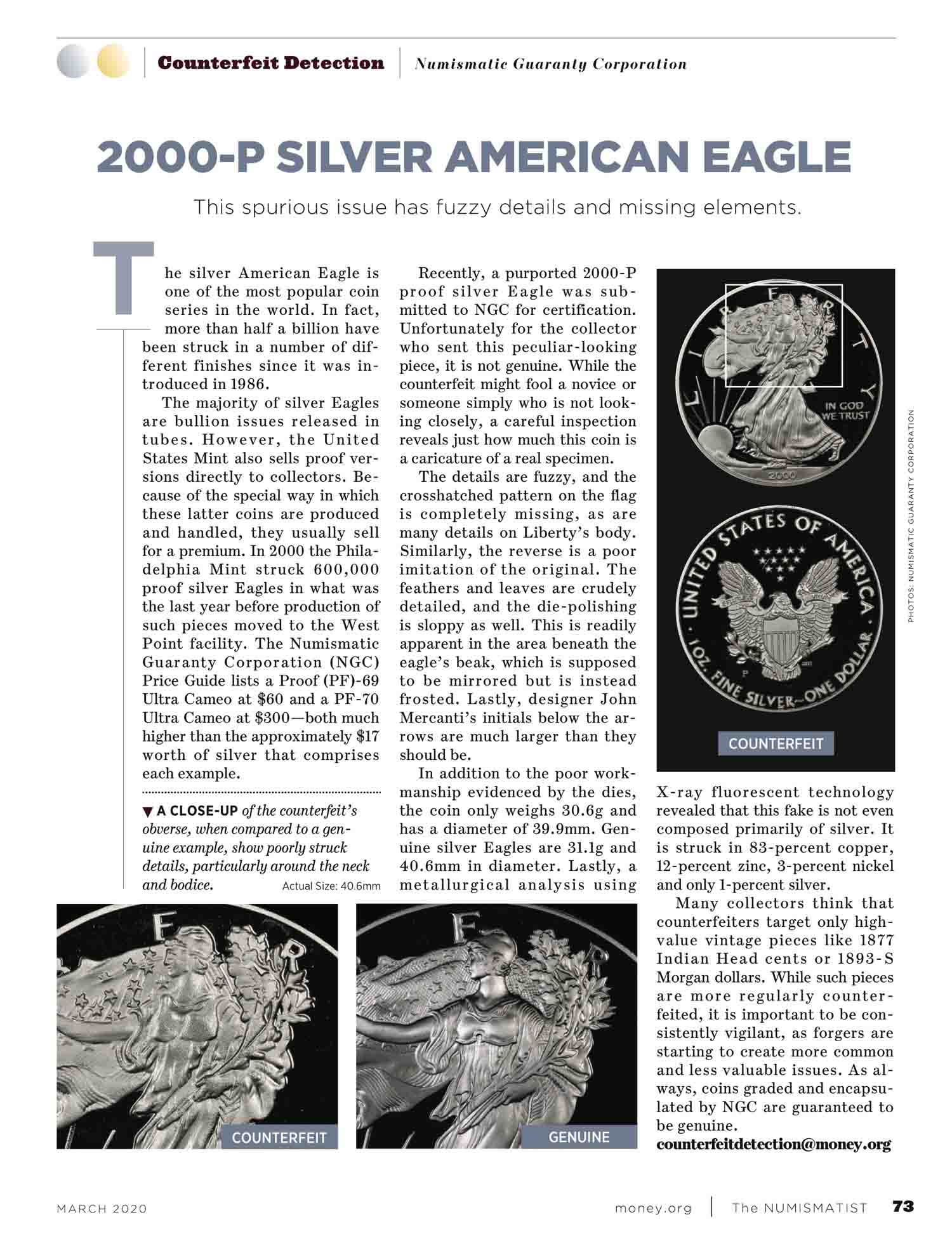

P.S. Parece que hay una alta demanda y consiguiente escasez de plata en USA

Earlier Wednesday we noted a report from Ronan Manly of BullionStar.com, who revealed that more than 50% of deliverable silver on COMEX is suddenly ‘not available.’ Manly brought up this Oct. 19 tweet from metals expert Nicky Shiels, who said of delegates in attendance at the annual LBMA (Gold) conference in Lisbon; «they are mildly bearish Gold for the year ahead ($1830 by 2023s conference) but super bullish Silver ($28.30!) as the focus was on physical tightness driven by unprecedented demand.«

More from Dr. Wall;

Silver stackers we talk to on a regular basis seem to be getting tired of hearing about the market tightness without any movement in the bank spot price. However, obviously that could be about to change if the COMEX and LBMA vault drain continues for much longer. One of the individuals I speak to regularly who has first hand knowledge of a COMEX depository’s operation told me recently that they didn’t think there’s any unspoken silver left, just people haven’t figured it out yet. An interesting comment, given that there is supposedly 35 million ounces of registered silver left at the COMEX.

Some silver bullion production is ordered out through March 2023 and nearly every silver round/coin is at least 4 weeks delayed from purchase, most 6-8 weeks. There already exists on the wholesale market what will be manifesting in retail trading across the space in the coming weeks: a complete uncoupling of price for live, deliverable Silver. You can already see that in the US Silver Mint Eagles where premiums are now nearly 100% of spot price. In the rare occurrence someone is quoting inventory that’s actually there, on a shelf and ready to ship that day, premium becomes almost irrelevant in this market. There’s virtually no price quoted that is too high with the benefit of 3 hours hindsight. You snooze, you lose. -Dr. Tyler Wall, SD Bullion, Inc.

The big question, as always – where do we go from here?

En la US Mint no hay American Silver Eagles (ASE) a la venta

https://catalog.usmint.gov/coins/silver-coins/

«Silver is a hedge against macroeconomic, systemic, geopolitical and inflationary risk with the attractive added potential for significant capital gains.»

Clearly silver is not a hedge against inflation, as your chart shows, the inflation-adjusted price has fallen for the better part of 250 years.

Neither silver nor gold show a positive correlation with inflation.

My opinion is let silver stay in the 18-21 range for years to come. I buy silver bullion every week and at that price, it’s a bargain. Started buying silver for my son when he was born in 1999. Too bad I did not have as much extra scratch back then as I do now !

My philosophy is simple. The silver (and gold) I buy is for him, so he can have a tangible asset in his possession in the future, that I believe will be worth more than it was when bought, and preserve it’s purchasing power when currencies shit the bed. It’s not an investment per se, and I don’t trade it ( I have every gram/ounce I ever purchased as well as every silver coin found via change or metal detecting…a hobby that can find precious metal, jewlery and change that can be converted into silver/gold bullion !).

I tell everyone I know, if you have a few extra bucks at the end of the week, buy an ASE or any other bullion coin from a local dealer ( even if the premium is a bit higher than the bigger guys). Get to know a coil dealer near you. The bullion coins, as well as the 90% silver coins, are really cool pieces of art, they feel good in your hand and WILL preserve purchasing power in the future better than ANY fiat currency…it’s PROVEN.

Heard it all before, a million times.

Gold going to $10,000 an ounce, silver to $150 an ounce or higher.

Sounds great, but never seems to materialize. All the arguments for it seems logical, yet never play out in reality.

33% rise, huh? I’m out about 33% of my initial investment in silver since I started believing these Ron Paul types. Fucking con men and controlled resistance, all of them.

BUY GOLD AND SILVER, BURY IT IN THE BACKYARD, AND WATCH IT DECREASE IN VALUE BY 33% MOTHERFUCKERS!! WAHOOO

At some point my gold and silver stack is going to be worth a lot more than I paid for it in worthless FIAT , I have no intention of selling and add some more each month REGARDLESS of the price. The FIAT price is meaningless it only affects the quantity I can afford at that time.

If I need a confidence boost I can go to KWN at any time !

Maybe Lagarde prediction for the 20th July 2014 is true and maybe it’s just hocus pocus ….It matters not I have PM stacks, an enormous store of food and items required to protect my family.

According to this lot (more hocus pocus)

http://atam.org/occult-message-in-speech-by-christine-lagarde-of-imf/

Cygnus is a black swan star shape which is going to get hit with a meteor shower on the 20th July 2014 as well.

Apparently an assignation attempt was made on Hitlers life on July 20th 1944 by Von Stauffenberg ( one of Germany’s Elite) so maybe this numerology thing is real .

Basically it does not matter if it’s Lagarde and next weekend or another trigger in three years time the dominoes WILL fall over at some point and those who put themselves in a better position to benefit or survive will be the very lucky ones.

This is our war against tyranny and injustice, our forefathers fought other types of wars with other types of metals.

We will win it’s just a matter of time ..

I will say again at the risk of aflood of red…gold is the only monetary metal. Silver was abandoned by the Chinese in 1935 and the French before that. The fact that silver has industrial uses is acctually a point against it being used to store long term wealth.

Consider if wheat were used. People would starve as the rich hoarded wheat. ditto for silver…industry does not want an important element hoarded.

Gold is the one element selected by humanity to serve this purpose.

Hate me for saying it but at least consider that you are fighting more than just the bullion banks when you save in silver.

QTips are go to $1000 in the coming months!

ZH has to stop posting so many wishful thinking bullshit articles about the metals.

With all we know that is bad and the metals still have not skyrocketed, are we missing something?

Hey Ray,

Nope, the population and technology curves are exponential. For all intents and purposes, they superimpose almost perfectly and look for all the world like asymptotes.

We simply cannot stay on this vertical trajectory for very much longer. Multiple choice:

A. Will it plateau?

B. Will it gracefully bend over and make a soft landing??

C. Orrr, will it drop precipitously and then recover back to a sustainable level???

It’s not given that we should see the future or know when it will overtake us…

Silver will do very well in the years ahead but this story makes it sound as though it will explode in price next week.

Currently retail demand for silver in Europe and North America is quite dismall. Almost any dealer or distributor you talk to will report laclustre sales as well as a fair amount of selling from the public. Just check ebay (or any internet dealer) premiums to confirm.

The problem for silver is the huge overhang of stale longs that regret not cashing out in the $40 range back in 2011. The manipulators understand this and use it to their benefit. For example, in May of 2011 nearly every North American refinery was flooded with larger bars and several were even refusing to buy silver. This situation made it easy for the shorts to run rampant and not be too concerned with delivery issues. Those who want to contain the price know that the public will buy smaller units such as one ounce coins while selling larger bars as the price rises. Blyhe Masters could explain this to you.

Currently the US and Canadian mints are going flat out producing one ounce coins. Retail demand for those same coins is well off the highs. Where are the coins going? Some automatically assume it’s Red China or other Asian markets. Fact is very few of those coins go to Red China as there are no distributors for either there. When you go to the shops in China to buy silver coins, the vast majority of imported product is from Australia. The few North American coins you see have been imported from North American retailers or distributors.

Ted Butler thinks the coins are being bought by financials on spec as the premiums are currently rock bottom. They hope to capitalize on higher premiums when public demand picks up. To me it seems a lot of work considering that such a transaction cannot be leveraged and the the silver component must be fully hedged. I would hazard a guess that surplus production is being put into some «continuity of gov’t» stockpile. I can’t say much beyond my guess being a very educated one.

We always hear about the great silver melt of the late seventies and early eighties. People lined up for blocks to sell the «family» silver. What is rarely mentioned is the public buying. Demand was so high then that refineries were opening up like dandelions in the spring to turn coins and flatware into bars to meet public demand. There are still considerable hoards in older hands that won’t hesitate the next time we see silver make a move higher. I suppose they are about as stale longs as you can get.

Point is that silver will see some dramatic price increases as well as «gut wrenching» declines in the future. It will indeed have its day but it will be one heck of a roller coaster ride. I suspect we will see pices over $100 but when that happens, expect corrections in excess of $60.

Don’t take this post as an excuse to not hold silver. It will be very important in the years ahead as will any liquid asset that is held outside the financial system. The monetary metals will be the premium assets.

En resumen, a saber lo que pasará