Enlace a mi tienda en ebid. Iré subiendo más moneditas de mi colección

https://stores.ebid.net/moneditis

(Este 1/2 dollar Barber no es exactamente junk silver 🙂 )

Junk silver is an informal term used in the United States, United Kingdom, Canada and Australia for any silver coin that is in fair or cull condition and has no numismatic or collectible value above the bullion value of the silver it contains. Such coins are popular among people seeking to invest in silver, particularly in small amounts. The word «junk» refers only to the value of the coins as collectibles and not to the actual condition of the coins; junk silver is not necessarily scrap silver.[1]

https://en.wikipedia.org/wiki/Junk_silver

Resumen de la trayectoria de desaparición de las monedas de oro y plata (pérdidas, fundición, retirada de circulación…)

«Silver and gold coins have always had their own special threats to survival in terms of melting. The gold recall order of 1933 resulted in massive amounts of gold coins being turned in for melting. While it was not the only time gold coins were ever melted, the Mint reported that over 39 percent of all the double eagles ever produce were melted and some 37 percent of all the gold eagles.»

«…silver coins have faced even more periods of destruction than gold. Although the production of both the gold eagle and silver dollar were suspended in 1804 it was the silver dollar that was attracting the most notice as a coin being exported by bullion speculators. In the early 1850s there were virtually no silver coins in circulation as bullion value exceeded face value. The amount of silver being put in these denominations was lowered in 1853, but that meant coins still unreleased were melted and privately held coins of the older and heavier weights were also subject to melting.

With rising silver prices, the temptation to melt silver coins has always been present. When silver soared in the late 1970s on its way to a record $50 price in early 1980, the temptation to melt became more of an imperative and tons of silver coins of all types were destroyed. Refineries were backed up for months. Prices paid for silver coins actually fell far below bullion value during this frantic period. At its widest, 90 percent silver coins worth 36 times face value were bringing only 24 times face.»

«Most of the melting took place in 1979 and 1980, when silver bullion soared to an all-time high of $50 an ounce. At that point, common-date silver coins were worth far more as metal than as money or collectibles. Even scarcer items could be melted at a profit.»

«Those coin melts probably hurt us more than we’ll ever know,» said Leon E. Hendrickson, proprietor of Silver Towne in Winchester, Ind., a dealership that has dealt extensively in bullion-related coins over the years. «They destroyed a lot of our `seed coins’ — the coins that got people started — and put a lot of collectors out of business.»

Hendrickson calculated that during 1979 and 1980, Silver Towne alone processed «thousands of bags» of silver coins that were destined for refiners’ melting pots. He pointed out, however, that while that period marked the peak of the great silver melts, it was really the culmination of a process that had started more than a decade earlier, for silver coins had been melted — surreptitiously at first and later more openly — since the 1960s.

He noted, too, that from the hobby’s standpoint, the loss of silver coins actually took place in two distinct stages: first, their withdrawal from circulation in the mid-1960s; and second, the melting itself. And, while the melting made the losses permanent, the physical withdrawal already had caused the hobby grievous harm.

«Coen estimated that of all the silver coins produced by the United States Mint, only about one-quarter survived the ongoing melts. He confided that he himself sold refiners $400 million worth of fabricated silver, mostly silver coins, during the one-year period from July 1, 1979 to June 30, 1980 — «and,» he commented, «other guys were doing the same thing.»

«With Franklin halves, for instance, I’d hate to say how big a majority were melted, but I know the percentage was high.»

On the contrary, key coins were almost always kept. And this led to one of the most fascinating — and also most significant — after-effects of the melts: a total rearrangement of relative rarity levels in every modern series of silver U.S. coins.

«Essentially,» Carr observed, «the key coins now are common, since they’re the ones that were saved — and the formerly common coins are now rare, since most of them were melted.

«Take Roosevelt dimes, for example. The 1949-S and the 1955-P, D and S are probably the commonest coins in the series today in circulated condition, whereas before the melts they were the scarcest. Being worth a premium, they were saved. In circulated condition, the new key may be the 1946-D or something like that — something where almost every available piece ended up being melted.»

«Forman, for one, questioned whether market analysts will ever really know, with any degree of certainty, just how many silver coins remain and how they break down by date and mint mark. In short, he didn’t believe — and still doesn’t today — that future buyers and sellers will ever again enjoy the security once provided by meaningful mintage figures.»

https://www.numismaticnews.net/article/news/general/where-coins-went-not-always-known-2

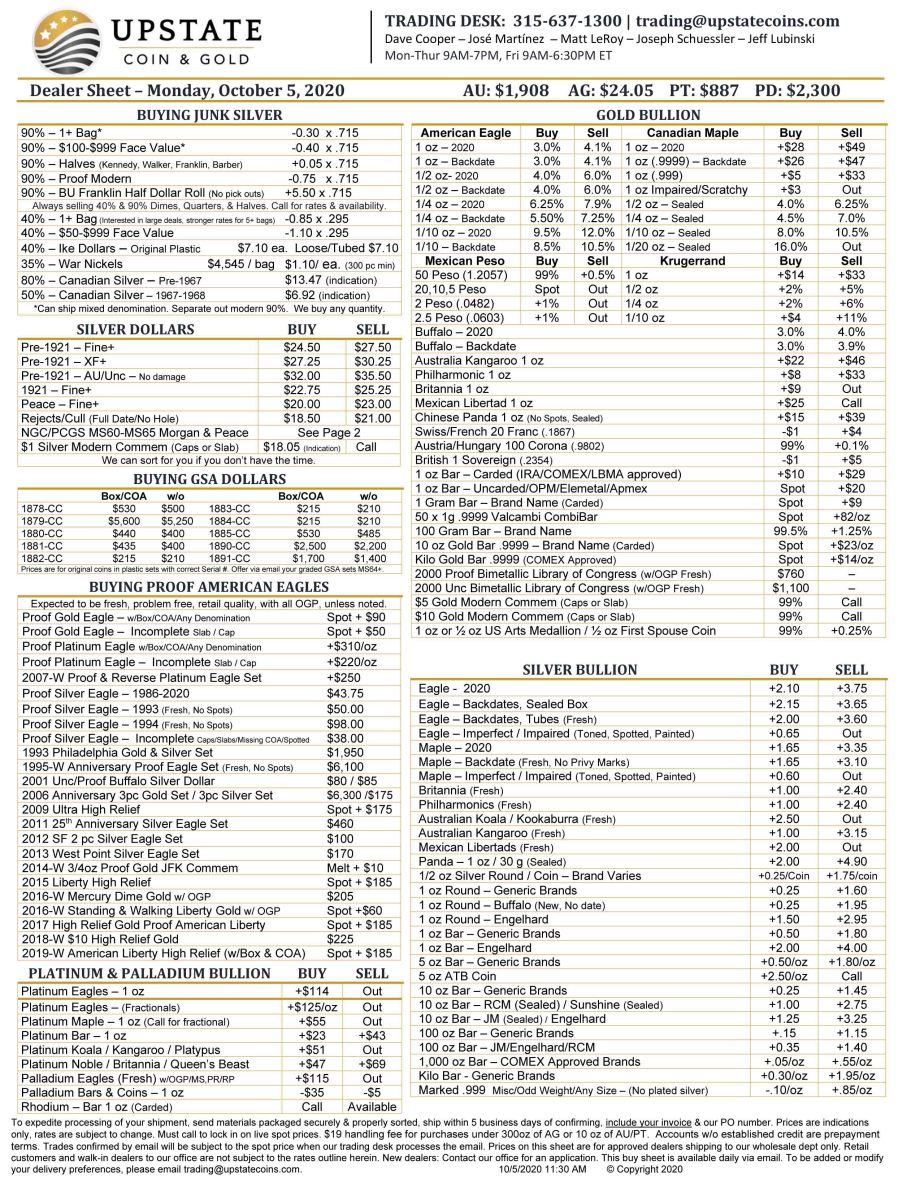

Referencia comerciantes (dealer sheet) de la empresa norteamericana Upstate coins utilizada por multitud de negocios al otro lado del atlántico relacionados con moneditas y/o metales preciosos. Actualización diaria.

https://trading.upstatecoins.com/wp-content/uploads/dealer.pdf

Monedas y precios

https://www.silveragecoins.com/es/list?list=4

Corta historia de la historia monetaria USA

https://coinsweekly.com/the-monetary-history-of-the-usa/

https://www.pcgs.com/news/after-the-melts-whats-left-in-silver-coins

«When silver hit $50 an ounce, I would say that 98 percent of the silver coins in existence were committed to smelting houses,» he confided. «If the price had been maintained, most everything would have been lost.

«Fortunately,» he added, «the refiners had a two- to three-month backlog, and as silver dropped in value they withdrew a lot of the coins. Even so, it’s scary just thinking of what might have happened.»

P.S. https://coinsweekly.com/how-to-detect-counterfeits-at-all-times-part-1-swiss-vreneli-coins/

Falsificaciones varias de la moneda de oro bullion 20 francos suizos oro vreneli

https://en.wikipedia.org/wiki/Vreneli

P.S.II Desvalijan Lamas Bolaño en Barcelona

https://eltaquigrafo.com/desvalijan-la-camara-acorazada-de-la-empresa-lamas-bolano/16122/